Most home insurance policies cover jewelry for 00 and silverware – Navigating the intricacies of homeowners insurance can be a daunting task, especially when it comes to understanding the coverage provided for valuable possessions like jewelry and silverware. This comprehensive guide delves into the coverage limits, exclusions, and claims process associated with most home insurance policies, empowering homeowners with the knowledge they need to protect their cherished belongings.

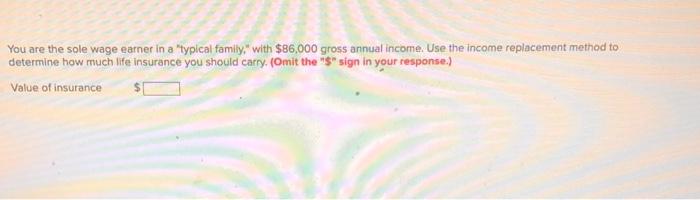

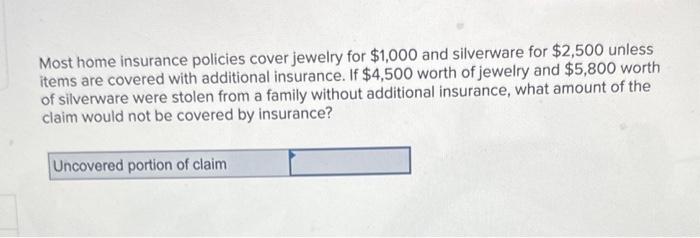

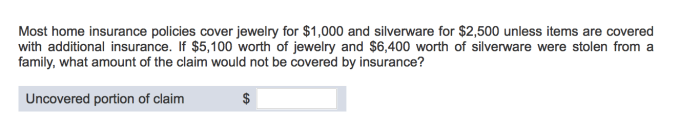

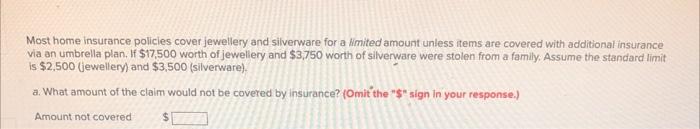

Most home insurance policies offer limited coverage for jewelry, typically up to $1,000, and silverware, providing a safety net in the event of loss or damage. However, it’s essential to be aware of any exclusions or limitations that may apply, ensuring adequate protection for your valuables.

Coverage Amount and Limitations

Most home insurance policies provide coverage for jewelry up to a limit of $ 1000. This limit applies to all jewelry, regardless of its value or type. However, there may be certain exclusions or limitations to this coverage, such as:

- Jewelry that is lost or stolen while you are away from home may not be covered.

- Jewelry that is damaged due to wear and tear or neglect may not be covered.

- Jewelry that is used for business purposes may not be covered.

Types of Jewelry Covered

The types of jewelry typically covered under this policy limit include:

- Rings

- Necklaces

- Bracelets

- Earrings

- Watches

However, there may be certain exclusions or conditions related to the type of jewelry, such as:

- Antique jewelry may require a separate appraisal to determine its value.

- Costume jewelry may not be covered at all.

Silverware Coverage

Most home insurance policies also provide coverage for silverware. The coverage limit for silverware is typically lower than the coverage limit for jewelry, and there may be certain exclusions or conditions related to the type of silverware, such as:

- Silverware that is lost or stolen while you are away from home may not be covered.

- Silverware that is damaged due to wear and tear or neglect may not be covered.

- Silverware that is used for business purposes may not be covered.

Valuation and Proof of Ownership

When you file a claim for jewelry or silverware loss or damage, you will need to provide proof of ownership and value. This can include receipts, appraisals, or photographs.

It is important to keep your receipts and appraisals in a safe place in case you need to file a claim.

Claims Process

To file a claim for jewelry or silverware loss or damage, you will need to contact your insurance company and provide them with the following information:

- A description of the lost or damaged item

- The date and time of the loss or damage

- The location of the loss or damage

- The police report (if applicable)

- Proof of ownership and value

Your insurance company will then investigate your claim and determine if you are eligible for coverage.

Riders and Endorsements

If you have valuable jewelry or silverware, you may want to consider purchasing a rider or endorsement to increase your coverage limits.

Riders and endorsements are additional policies that can be added to your home insurance policy to provide additional coverage for specific items.

There are different types of riders available, such as:

- Jewelry riders

- Silverware riders

- Valuable items riders

The cost of a rider or endorsement will vary depending on the type of coverage and the value of the items you are insuring.

FAQ Guide: Most Home Insurance Policies Cover Jewelry For 00 And Silverware

What types of jewelry are typically covered under most home insurance policies?

Most home insurance policies cover a wide range of jewelry items, including rings, necklaces, bracelets, earrings, and watches. However, it’s important to check your specific policy for any exclusions or limitations.

What is the difference between coverage for jewelry and silverware under most home insurance policies?

While most home insurance policies provide coverage for both jewelry and silverware, the coverage limits and conditions may differ. Silverware is often covered under a separate category with its own coverage limit, which may be lower than the limit for jewelry.

What steps should I take to file a claim for lost or damaged jewelry or silverware?

To file a claim for lost or damaged jewelry or silverware, you should contact your insurance company as soon as possible. Be prepared to provide documentation such as receipts, appraisals, or photographs to support your claim.